ERC Newsroom

IRS Updates, Tax Tips, and Program Information. Anything you want to know to help your business get the money is deserves you can find right here.

Declared Disasters

How Natural Disasters Affect Business Valuations

How Natural Disasters Affect Business Valuations

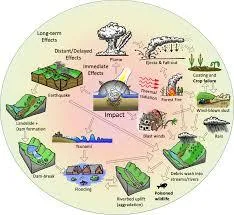

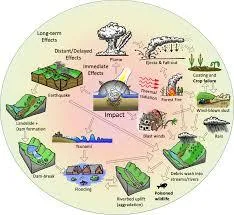

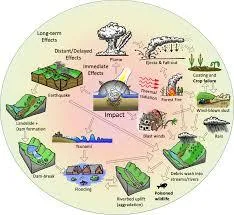

Natural disasters can turn a thriving business into a fragile one overnight. While physical damage is the most visible consequence, the financial and operational impacts run much deeper—especially when it comes to business valuation.

Whether you’re looking to sell, secure funding, or bring on investors, understanding how a disaster affects your company’s value is critical to rebuilding smart and staying resilient. In this article, we’ll explore how disasters disrupt business valuations and what steps you can take to protect your company’s worth.

1. Immediate Impacts on Business Valuation

📉 Physical Asset Losses

Flooding, fire, wind, or structural collapse can destroy property, equipment, or inventory. This directly reduces tangible asset value—an essential component of your balance sheet.

⛔ Operational Disruptions

A shutdown—whether for days, weeks, or months—leads to lost revenue, stalled productivity, and broken supply chains. This sudden change in performance will show up in trailing financials and lower your company’s value to potential buyers or lenders.

💡 Buyer and Lender Confidence

A history of disasters (especially if you're uninsured or underprepared) may raise red flags for investors or banks. They may factor in higher perceived risk, increasing your cost of capital or decreasing your business’s marketability.

2. Long-Term Value Erosion

📉 Lower Earnings Multiples

Valuations often rely on multiples of earnings (EBITDA or revenue). If a disaster drags down earnings—even temporarily—it can lower your valuation for years.

Example:

A business typically valued at 5× EBITDA might only get 3× if recent performance reflects instability or prolonged recovery.

🚫 Reputational Damage

If customers perceive a decline in service or safety, long-term revenue projections could drop, reducing forecasted cash flows used in valuation models.

🔍 Reduced Buyer Interest

Many buyers shy away from businesses that appear high-risk or require major capital investments to restore. This limits your pool of acquirers, which can drive down offers.

3. Insurance Gaps and Their Consequences

🧾 Uninsured or Underinsured Losses

If your business doesn't carry adequate insurance—or fails to claim in time—you may be responsible for recovery costs. This financial strain can result in higher liabilities and lower working capital, both of which impact valuation metrics.

⚠️ Pending Claims or Litigation

Ongoing insurance disputes or lawsuits stemming from the disaster can appear on your books as contingent liabilities. Investors and buyers often subtract these risks from the total business value.

4. How to Preserve or Regain Business Value

✅ Document Everything

After a disaster, meticulous records of damage, downtime, and recovery costs can help:

Justify losses to insurers

Inform updated financial models

Reassure stakeholders and appraisers

✅ Rebuild with Resilience in Mind

Buyers favor businesses that show disaster-readiness. Investing in prevention, continuity planning, and strong leadership during recovery can demonstrate operational strength and add to long-term value.

✅ Seek Professional Valuations

Have your business reassessed after the dust settles. A valuation expert can adjust for one-time events and explain to buyers or funders why your business remains strong.

5. How Business Networks Can Help You Rebound

Engaging with a strong network of recovery professionals—public adjusters, consultants, financial advisors, legal experts—can speed up your recovery and strengthen your positioning. These networks also connect you with:

Grant and loan programs

Business continuity services

Buyers, funders, or partners interested in rebuilding efforts

A robust support system helps reduce downtime and restore stakeholder confidence, which can go a long way in protecting your business valuation.

Natural disasters don’t just destroy physical assets—they threaten the financial core of your business. But with smart strategies and support, your business can recover and retain much of its value.

Key Takeaways:

Disasters can lower business valuations due to asset loss, reduced revenue, and investor uncertainty.

Uninsured losses and reputational damage can have long-lasting effects.

Proactive recovery, strong documentation, and expert support are key to preserving value.

How Business Networks Can Aid in Recovery

Click the "Get Assistance" button to begin the process — we are here to help!

Natural Disasters

How Natural Disasters Affect Business Valuations

How Natural Disasters Affect Business Valuations

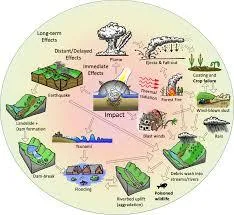

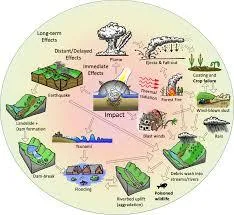

Natural disasters can turn a thriving business into a fragile one overnight. While physical damage is the most visible consequence, the financial and operational impacts run much deeper—especially when it comes to business valuation.

Whether you’re looking to sell, secure funding, or bring on investors, understanding how a disaster affects your company’s value is critical to rebuilding smart and staying resilient. In this article, we’ll explore how disasters disrupt business valuations and what steps you can take to protect your company’s worth.

1. Immediate Impacts on Business Valuation

📉 Physical Asset Losses

Flooding, fire, wind, or structural collapse can destroy property, equipment, or inventory. This directly reduces tangible asset value—an essential component of your balance sheet.

⛔ Operational Disruptions

A shutdown—whether for days, weeks, or months—leads to lost revenue, stalled productivity, and broken supply chains. This sudden change in performance will show up in trailing financials and lower your company’s value to potential buyers or lenders.

💡 Buyer and Lender Confidence

A history of disasters (especially if you're uninsured or underprepared) may raise red flags for investors or banks. They may factor in higher perceived risk, increasing your cost of capital or decreasing your business’s marketability.

2. Long-Term Value Erosion

📉 Lower Earnings Multiples

Valuations often rely on multiples of earnings (EBITDA or revenue). If a disaster drags down earnings—even temporarily—it can lower your valuation for years.

Example:

A business typically valued at 5× EBITDA might only get 3× if recent performance reflects instability or prolonged recovery.

🚫 Reputational Damage

If customers perceive a decline in service or safety, long-term revenue projections could drop, reducing forecasted cash flows used in valuation models.

🔍 Reduced Buyer Interest

Many buyers shy away from businesses that appear high-risk or require major capital investments to restore. This limits your pool of acquirers, which can drive down offers.

3. Insurance Gaps and Their Consequences

🧾 Uninsured or Underinsured Losses

If your business doesn't carry adequate insurance—or fails to claim in time—you may be responsible for recovery costs. This financial strain can result in higher liabilities and lower working capital, both of which impact valuation metrics.

⚠️ Pending Claims or Litigation

Ongoing insurance disputes or lawsuits stemming from the disaster can appear on your books as contingent liabilities. Investors and buyers often subtract these risks from the total business value.

4. How to Preserve or Regain Business Value

✅ Document Everything

After a disaster, meticulous records of damage, downtime, and recovery costs can help:

Justify losses to insurers

Inform updated financial models

Reassure stakeholders and appraisers

✅ Rebuild with Resilience in Mind

Buyers favor businesses that show disaster-readiness. Investing in prevention, continuity planning, and strong leadership during recovery can demonstrate operational strength and add to long-term value.

✅ Seek Professional Valuations

Have your business reassessed after the dust settles. A valuation expert can adjust for one-time events and explain to buyers or funders why your business remains strong.

5. How Business Networks Can Help You Rebound

Engaging with a strong network of recovery professionals—public adjusters, consultants, financial advisors, legal experts—can speed up your recovery and strengthen your positioning. These networks also connect you with:

Grant and loan programs

Business continuity services

Buyers, funders, or partners interested in rebuilding efforts

A robust support system helps reduce downtime and restore stakeholder confidence, which can go a long way in protecting your business valuation.

Natural disasters don’t just destroy physical assets—they threaten the financial core of your business. But with smart strategies and support, your business can recover and retain much of its value.

Key Takeaways:

Disasters can lower business valuations due to asset loss, reduced revenue, and investor uncertainty.

Uninsured losses and reputational damage can have long-lasting effects.

Proactive recovery, strong documentation, and expert support are key to preserving value.

How Business Networks Can Aid in Recovery

Click the "Get Assistance" button to begin the process — we are here to help!

Disaster Readiness

How Natural Disasters Affect Business Valuations

How Natural Disasters Affect Business Valuations

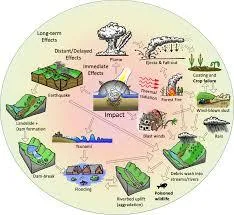

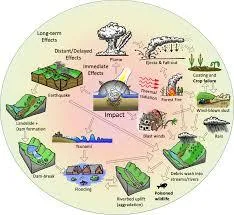

Natural disasters can turn a thriving business into a fragile one overnight. While physical damage is the most visible consequence, the financial and operational impacts run much deeper—especially when it comes to business valuation.

Whether you’re looking to sell, secure funding, or bring on investors, understanding how a disaster affects your company’s value is critical to rebuilding smart and staying resilient. In this article, we’ll explore how disasters disrupt business valuations and what steps you can take to protect your company’s worth.

1. Immediate Impacts on Business Valuation

📉 Physical Asset Losses

Flooding, fire, wind, or structural collapse can destroy property, equipment, or inventory. This directly reduces tangible asset value—an essential component of your balance sheet.

⛔ Operational Disruptions

A shutdown—whether for days, weeks, or months—leads to lost revenue, stalled productivity, and broken supply chains. This sudden change in performance will show up in trailing financials and lower your company’s value to potential buyers or lenders.

💡 Buyer and Lender Confidence

A history of disasters (especially if you're uninsured or underprepared) may raise red flags for investors or banks. They may factor in higher perceived risk, increasing your cost of capital or decreasing your business’s marketability.

2. Long-Term Value Erosion

📉 Lower Earnings Multiples

Valuations often rely on multiples of earnings (EBITDA or revenue). If a disaster drags down earnings—even temporarily—it can lower your valuation for years.

Example:

A business typically valued at 5× EBITDA might only get 3× if recent performance reflects instability or prolonged recovery.

🚫 Reputational Damage

If customers perceive a decline in service or safety, long-term revenue projections could drop, reducing forecasted cash flows used in valuation models.

🔍 Reduced Buyer Interest

Many buyers shy away from businesses that appear high-risk or require major capital investments to restore. This limits your pool of acquirers, which can drive down offers.

3. Insurance Gaps and Their Consequences

🧾 Uninsured or Underinsured Losses

If your business doesn't carry adequate insurance—or fails to claim in time—you may be responsible for recovery costs. This financial strain can result in higher liabilities and lower working capital, both of which impact valuation metrics.

⚠️ Pending Claims or Litigation

Ongoing insurance disputes or lawsuits stemming from the disaster can appear on your books as contingent liabilities. Investors and buyers often subtract these risks from the total business value.

4. How to Preserve or Regain Business Value

✅ Document Everything

After a disaster, meticulous records of damage, downtime, and recovery costs can help:

Justify losses to insurers

Inform updated financial models

Reassure stakeholders and appraisers

✅ Rebuild with Resilience in Mind

Buyers favor businesses that show disaster-readiness. Investing in prevention, continuity planning, and strong leadership during recovery can demonstrate operational strength and add to long-term value.

✅ Seek Professional Valuations

Have your business reassessed after the dust settles. A valuation expert can adjust for one-time events and explain to buyers or funders why your business remains strong.

5. How Business Networks Can Help You Rebound

Engaging with a strong network of recovery professionals—public adjusters, consultants, financial advisors, legal experts—can speed up your recovery and strengthen your positioning. These networks also connect you with:

Grant and loan programs

Business continuity services

Buyers, funders, or partners interested in rebuilding efforts

A robust support system helps reduce downtime and restore stakeholder confidence, which can go a long way in protecting your business valuation.

Natural disasters don’t just destroy physical assets—they threaten the financial core of your business. But with smart strategies and support, your business can recover and retain much of its value.

Key Takeaways:

Disasters can lower business valuations due to asset loss, reduced revenue, and investor uncertainty.

Uninsured losses and reputational damage can have long-lasting effects.

Proactive recovery, strong documentation, and expert support are key to preserving value.

How Business Networks Can Aid in Recovery

Click the "Get Assistance" button to begin the process — we are here to help!

Disaster Recovery

How Natural Disasters Affect Business Valuations

How Natural Disasters Affect Business Valuations

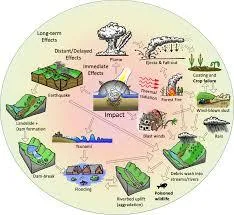

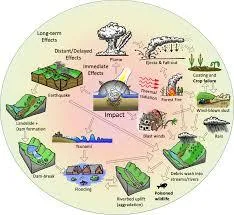

Natural disasters can turn a thriving business into a fragile one overnight. While physical damage is the most visible consequence, the financial and operational impacts run much deeper—especially when it comes to business valuation.

Whether you’re looking to sell, secure funding, or bring on investors, understanding how a disaster affects your company’s value is critical to rebuilding smart and staying resilient. In this article, we’ll explore how disasters disrupt business valuations and what steps you can take to protect your company’s worth.

1. Immediate Impacts on Business Valuation

📉 Physical Asset Losses

Flooding, fire, wind, or structural collapse can destroy property, equipment, or inventory. This directly reduces tangible asset value—an essential component of your balance sheet.

⛔ Operational Disruptions

A shutdown—whether for days, weeks, or months—leads to lost revenue, stalled productivity, and broken supply chains. This sudden change in performance will show up in trailing financials and lower your company’s value to potential buyers or lenders.

💡 Buyer and Lender Confidence

A history of disasters (especially if you're uninsured or underprepared) may raise red flags for investors or banks. They may factor in higher perceived risk, increasing your cost of capital or decreasing your business’s marketability.

2. Long-Term Value Erosion

📉 Lower Earnings Multiples

Valuations often rely on multiples of earnings (EBITDA or revenue). If a disaster drags down earnings—even temporarily—it can lower your valuation for years.

Example:

A business typically valued at 5× EBITDA might only get 3× if recent performance reflects instability or prolonged recovery.

🚫 Reputational Damage

If customers perceive a decline in service or safety, long-term revenue projections could drop, reducing forecasted cash flows used in valuation models.

🔍 Reduced Buyer Interest

Many buyers shy away from businesses that appear high-risk or require major capital investments to restore. This limits your pool of acquirers, which can drive down offers.

3. Insurance Gaps and Their Consequences

🧾 Uninsured or Underinsured Losses

If your business doesn't carry adequate insurance—or fails to claim in time—you may be responsible for recovery costs. This financial strain can result in higher liabilities and lower working capital, both of which impact valuation metrics.

⚠️ Pending Claims or Litigation

Ongoing insurance disputes or lawsuits stemming from the disaster can appear on your books as contingent liabilities. Investors and buyers often subtract these risks from the total business value.

4. How to Preserve or Regain Business Value

✅ Document Everything

After a disaster, meticulous records of damage, downtime, and recovery costs can help:

Justify losses to insurers

Inform updated financial models

Reassure stakeholders and appraisers

✅ Rebuild with Resilience in Mind

Buyers favor businesses that show disaster-readiness. Investing in prevention, continuity planning, and strong leadership during recovery can demonstrate operational strength and add to long-term value.

✅ Seek Professional Valuations

Have your business reassessed after the dust settles. A valuation expert can adjust for one-time events and explain to buyers or funders why your business remains strong.

5. How Business Networks Can Help You Rebound

Engaging with a strong network of recovery professionals—public adjusters, consultants, financial advisors, legal experts—can speed up your recovery and strengthen your positioning. These networks also connect you with:

Grant and loan programs

Business continuity services

Buyers, funders, or partners interested in rebuilding efforts

A robust support system helps reduce downtime and restore stakeholder confidence, which can go a long way in protecting your business valuation.

Natural disasters don’t just destroy physical assets—they threaten the financial core of your business. But with smart strategies and support, your business can recover and retain much of its value.

Key Takeaways:

Disasters can lower business valuations due to asset loss, reduced revenue, and investor uncertainty.

Uninsured losses and reputational damage can have long-lasting effects.

Proactive recovery, strong documentation, and expert support are key to preserving value.

How Business Networks Can Aid in Recovery

Click the "Get Assistance" button to begin the process — we are here to help!

ClimateTech

How Natural Disasters Affect Business Valuations

How Natural Disasters Affect Business Valuations

Natural disasters can turn a thriving business into a fragile one overnight. While physical damage is the most visible consequence, the financial and operational impacts run much deeper—especially when it comes to business valuation.

Whether you’re looking to sell, secure funding, or bring on investors, understanding how a disaster affects your company’s value is critical to rebuilding smart and staying resilient. In this article, we’ll explore how disasters disrupt business valuations and what steps you can take to protect your company’s worth.

1. Immediate Impacts on Business Valuation

📉 Physical Asset Losses

Flooding, fire, wind, or structural collapse can destroy property, equipment, or inventory. This directly reduces tangible asset value—an essential component of your balance sheet.

⛔ Operational Disruptions

A shutdown—whether for days, weeks, or months—leads to lost revenue, stalled productivity, and broken supply chains. This sudden change in performance will show up in trailing financials and lower your company’s value to potential buyers or lenders.

💡 Buyer and Lender Confidence

A history of disasters (especially if you're uninsured or underprepared) may raise red flags for investors or banks. They may factor in higher perceived risk, increasing your cost of capital or decreasing your business’s marketability.

2. Long-Term Value Erosion

📉 Lower Earnings Multiples

Valuations often rely on multiples of earnings (EBITDA or revenue). If a disaster drags down earnings—even temporarily—it can lower your valuation for years.

Example:

A business typically valued at 5× EBITDA might only get 3× if recent performance reflects instability or prolonged recovery.

🚫 Reputational Damage

If customers perceive a decline in service or safety, long-term revenue projections could drop, reducing forecasted cash flows used in valuation models.

🔍 Reduced Buyer Interest

Many buyers shy away from businesses that appear high-risk or require major capital investments to restore. This limits your pool of acquirers, which can drive down offers.

3. Insurance Gaps and Their Consequences

🧾 Uninsured or Underinsured Losses

If your business doesn't carry adequate insurance—or fails to claim in time—you may be responsible for recovery costs. This financial strain can result in higher liabilities and lower working capital, both of which impact valuation metrics.

⚠️ Pending Claims or Litigation

Ongoing insurance disputes or lawsuits stemming from the disaster can appear on your books as contingent liabilities. Investors and buyers often subtract these risks from the total business value.

4. How to Preserve or Regain Business Value

✅ Document Everything

After a disaster, meticulous records of damage, downtime, and recovery costs can help:

Justify losses to insurers

Inform updated financial models

Reassure stakeholders and appraisers

✅ Rebuild with Resilience in Mind

Buyers favor businesses that show disaster-readiness. Investing in prevention, continuity planning, and strong leadership during recovery can demonstrate operational strength and add to long-term value.

✅ Seek Professional Valuations

Have your business reassessed after the dust settles. A valuation expert can adjust for one-time events and explain to buyers or funders why your business remains strong.

5. How Business Networks Can Help You Rebound

Engaging with a strong network of recovery professionals—public adjusters, consultants, financial advisors, legal experts—can speed up your recovery and strengthen your positioning. These networks also connect you with:

Grant and loan programs

Business continuity services

Buyers, funders, or partners interested in rebuilding efforts

A robust support system helps reduce downtime and restore stakeholder confidence, which can go a long way in protecting your business valuation.

Natural disasters don’t just destroy physical assets—they threaten the financial core of your business. But with smart strategies and support, your business can recover and retain much of its value.

Key Takeaways:

Disasters can lower business valuations due to asset loss, reduced revenue, and investor uncertainty.

Uninsured losses and reputational damage can have long-lasting effects.

Proactive recovery, strong documentation, and expert support are key to preserving value.

How Business Networks Can Aid in Recovery

Click the "Get Assistance" button to begin the process — we are here to help!

Program Updates

How Natural Disasters Affect Business Valuations

How Natural Disasters Affect Business Valuations

Natural disasters can turn a thriving business into a fragile one overnight. While physical damage is the most visible consequence, the financial and operational impacts run much deeper—especially when it comes to business valuation.

Whether you’re looking to sell, secure funding, or bring on investors, understanding how a disaster affects your company’s value is critical to rebuilding smart and staying resilient. In this article, we’ll explore how disasters disrupt business valuations and what steps you can take to protect your company’s worth.

1. Immediate Impacts on Business Valuation

📉 Physical Asset Losses

Flooding, fire, wind, or structural collapse can destroy property, equipment, or inventory. This directly reduces tangible asset value—an essential component of your balance sheet.

⛔ Operational Disruptions

A shutdown—whether for days, weeks, or months—leads to lost revenue, stalled productivity, and broken supply chains. This sudden change in performance will show up in trailing financials and lower your company’s value to potential buyers or lenders.

💡 Buyer and Lender Confidence

A history of disasters (especially if you're uninsured or underprepared) may raise red flags for investors or banks. They may factor in higher perceived risk, increasing your cost of capital or decreasing your business’s marketability.

2. Long-Term Value Erosion

📉 Lower Earnings Multiples

Valuations often rely on multiples of earnings (EBITDA or revenue). If a disaster drags down earnings—even temporarily—it can lower your valuation for years.

Example:

A business typically valued at 5× EBITDA might only get 3× if recent performance reflects instability or prolonged recovery.

🚫 Reputational Damage

If customers perceive a decline in service or safety, long-term revenue projections could drop, reducing forecasted cash flows used in valuation models.

🔍 Reduced Buyer Interest

Many buyers shy away from businesses that appear high-risk or require major capital investments to restore. This limits your pool of acquirers, which can drive down offers.

3. Insurance Gaps and Their Consequences

🧾 Uninsured or Underinsured Losses

If your business doesn't carry adequate insurance—or fails to claim in time—you may be responsible for recovery costs. This financial strain can result in higher liabilities and lower working capital, both of which impact valuation metrics.

⚠️ Pending Claims or Litigation

Ongoing insurance disputes or lawsuits stemming from the disaster can appear on your books as contingent liabilities. Investors and buyers often subtract these risks from the total business value.

4. How to Preserve or Regain Business Value

✅ Document Everything

After a disaster, meticulous records of damage, downtime, and recovery costs can help:

Justify losses to insurers

Inform updated financial models

Reassure stakeholders and appraisers

✅ Rebuild with Resilience in Mind

Buyers favor businesses that show disaster-readiness. Investing in prevention, continuity planning, and strong leadership during recovery can demonstrate operational strength and add to long-term value.

✅ Seek Professional Valuations

Have your business reassessed after the dust settles. A valuation expert can adjust for one-time events and explain to buyers or funders why your business remains strong.

5. How Business Networks Can Help You Rebound

Engaging with a strong network of recovery professionals—public adjusters, consultants, financial advisors, legal experts—can speed up your recovery and strengthen your positioning. These networks also connect you with:

Grant and loan programs

Business continuity services

Buyers, funders, or partners interested in rebuilding efforts

A robust support system helps reduce downtime and restore stakeholder confidence, which can go a long way in protecting your business valuation.

Natural disasters don’t just destroy physical assets—they threaten the financial core of your business. But with smart strategies and support, your business can recover and retain much of its value.

Key Takeaways:

Disasters can lower business valuations due to asset loss, reduced revenue, and investor uncertainty.

Uninsured losses and reputational damage can have long-lasting effects.

Proactive recovery, strong documentation, and expert support are key to preserving value.

How Business Networks Can Aid in Recovery

Click the "Get Assistance" button to begin the process — we are here to help!

IRS Updates

How Natural Disasters Affect Business Valuations

How Natural Disasters Affect Business Valuations

Natural disasters can turn a thriving business into a fragile one overnight. While physical damage is the most visible consequence, the financial and operational impacts run much deeper—especially when it comes to business valuation.

Whether you’re looking to sell, secure funding, or bring on investors, understanding how a disaster affects your company’s value is critical to rebuilding smart and staying resilient. In this article, we’ll explore how disasters disrupt business valuations and what steps you can take to protect your company’s worth.

1. Immediate Impacts on Business Valuation

📉 Physical Asset Losses

Flooding, fire, wind, or structural collapse can destroy property, equipment, or inventory. This directly reduces tangible asset value—an essential component of your balance sheet.

⛔ Operational Disruptions

A shutdown—whether for days, weeks, or months—leads to lost revenue, stalled productivity, and broken supply chains. This sudden change in performance will show up in trailing financials and lower your company’s value to potential buyers or lenders.

💡 Buyer and Lender Confidence

A history of disasters (especially if you're uninsured or underprepared) may raise red flags for investors or banks. They may factor in higher perceived risk, increasing your cost of capital or decreasing your business’s marketability.

2. Long-Term Value Erosion

📉 Lower Earnings Multiples

Valuations often rely on multiples of earnings (EBITDA or revenue). If a disaster drags down earnings—even temporarily—it can lower your valuation for years.

Example:

A business typically valued at 5× EBITDA might only get 3× if recent performance reflects instability or prolonged recovery.

🚫 Reputational Damage

If customers perceive a decline in service or safety, long-term revenue projections could drop, reducing forecasted cash flows used in valuation models.

🔍 Reduced Buyer Interest

Many buyers shy away from businesses that appear high-risk or require major capital investments to restore. This limits your pool of acquirers, which can drive down offers.

3. Insurance Gaps and Their Consequences

🧾 Uninsured or Underinsured Losses

If your business doesn't carry adequate insurance—or fails to claim in time—you may be responsible for recovery costs. This financial strain can result in higher liabilities and lower working capital, both of which impact valuation metrics.

⚠️ Pending Claims or Litigation

Ongoing insurance disputes or lawsuits stemming from the disaster can appear on your books as contingent liabilities. Investors and buyers often subtract these risks from the total business value.

4. How to Preserve or Regain Business Value

✅ Document Everything

After a disaster, meticulous records of damage, downtime, and recovery costs can help:

Justify losses to insurers

Inform updated financial models

Reassure stakeholders and appraisers

✅ Rebuild with Resilience in Mind

Buyers favor businesses that show disaster-readiness. Investing in prevention, continuity planning, and strong leadership during recovery can demonstrate operational strength and add to long-term value.

✅ Seek Professional Valuations

Have your business reassessed after the dust settles. A valuation expert can adjust for one-time events and explain to buyers or funders why your business remains strong.

5. How Business Networks Can Help You Rebound

Engaging with a strong network of recovery professionals—public adjusters, consultants, financial advisors, legal experts—can speed up your recovery and strengthen your positioning. These networks also connect you with:

Grant and loan programs

Business continuity services

Buyers, funders, or partners interested in rebuilding efforts

A robust support system helps reduce downtime and restore stakeholder confidence, which can go a long way in protecting your business valuation.

Natural disasters don’t just destroy physical assets—they threaten the financial core of your business. But with smart strategies and support, your business can recover and retain much of its value.

Key Takeaways:

Disasters can lower business valuations due to asset loss, reduced revenue, and investor uncertainty.

Uninsured losses and reputational damage can have long-lasting effects.

Proactive recovery, strong documentation, and expert support are key to preserving value.

How Business Networks Can Aid in Recovery

Click the "Get Assistance" button to begin the process — we are here to help!

Tax Tips

How Natural Disasters Affect Business Valuations

How Natural Disasters Affect Business Valuations

Natural disasters can turn a thriving business into a fragile one overnight. While physical damage is the most visible consequence, the financial and operational impacts run much deeper—especially when it comes to business valuation.

Whether you’re looking to sell, secure funding, or bring on investors, understanding how a disaster affects your company’s value is critical to rebuilding smart and staying resilient. In this article, we’ll explore how disasters disrupt business valuations and what steps you can take to protect your company’s worth.

1. Immediate Impacts on Business Valuation

📉 Physical Asset Losses

Flooding, fire, wind, or structural collapse can destroy property, equipment, or inventory. This directly reduces tangible asset value—an essential component of your balance sheet.

⛔ Operational Disruptions

A shutdown—whether for days, weeks, or months—leads to lost revenue, stalled productivity, and broken supply chains. This sudden change in performance will show up in trailing financials and lower your company’s value to potential buyers or lenders.

💡 Buyer and Lender Confidence

A history of disasters (especially if you're uninsured or underprepared) may raise red flags for investors or banks. They may factor in higher perceived risk, increasing your cost of capital or decreasing your business’s marketability.

2. Long-Term Value Erosion

📉 Lower Earnings Multiples

Valuations often rely on multiples of earnings (EBITDA or revenue). If a disaster drags down earnings—even temporarily—it can lower your valuation for years.

Example:

A business typically valued at 5× EBITDA might only get 3× if recent performance reflects instability or prolonged recovery.

🚫 Reputational Damage

If customers perceive a decline in service or safety, long-term revenue projections could drop, reducing forecasted cash flows used in valuation models.

🔍 Reduced Buyer Interest

Many buyers shy away from businesses that appear high-risk or require major capital investments to restore. This limits your pool of acquirers, which can drive down offers.

3. Insurance Gaps and Their Consequences

🧾 Uninsured or Underinsured Losses

If your business doesn't carry adequate insurance—or fails to claim in time—you may be responsible for recovery costs. This financial strain can result in higher liabilities and lower working capital, both of which impact valuation metrics.

⚠️ Pending Claims or Litigation

Ongoing insurance disputes or lawsuits stemming from the disaster can appear on your books as contingent liabilities. Investors and buyers often subtract these risks from the total business value.

4. How to Preserve or Regain Business Value

✅ Document Everything

After a disaster, meticulous records of damage, downtime, and recovery costs can help:

Justify losses to insurers

Inform updated financial models

Reassure stakeholders and appraisers

✅ Rebuild with Resilience in Mind

Buyers favor businesses that show disaster-readiness. Investing in prevention, continuity planning, and strong leadership during recovery can demonstrate operational strength and add to long-term value.

✅ Seek Professional Valuations

Have your business reassessed after the dust settles. A valuation expert can adjust for one-time events and explain to buyers or funders why your business remains strong.

5. How Business Networks Can Help You Rebound

Engaging with a strong network of recovery professionals—public adjusters, consultants, financial advisors, legal experts—can speed up your recovery and strengthen your positioning. These networks also connect you with:

Grant and loan programs

Business continuity services

Buyers, funders, or partners interested in rebuilding efforts

A robust support system helps reduce downtime and restore stakeholder confidence, which can go a long way in protecting your business valuation.

Natural disasters don’t just destroy physical assets—they threaten the financial core of your business. But with smart strategies and support, your business can recover and retain much of its value.

Key Takeaways:

Disasters can lower business valuations due to asset loss, reduced revenue, and investor uncertainty.

Uninsured losses and reputational damage can have long-lasting effects.

Proactive recovery, strong documentation, and expert support are key to preserving value.

How Business Networks Can Aid in Recovery

Click the "Get Assistance" button to begin the process — we are here to help!

ERC Company News

How Natural Disasters Affect Business Valuations

How Natural Disasters Affect Business Valuations

Natural disasters can turn a thriving business into a fragile one overnight. While physical damage is the most visible consequence, the financial and operational impacts run much deeper—especially when it comes to business valuation.

Whether you’re looking to sell, secure funding, or bring on investors, understanding how a disaster affects your company’s value is critical to rebuilding smart and staying resilient. In this article, we’ll explore how disasters disrupt business valuations and what steps you can take to protect your company’s worth.

1. Immediate Impacts on Business Valuation

📉 Physical Asset Losses

Flooding, fire, wind, or structural collapse can destroy property, equipment, or inventory. This directly reduces tangible asset value—an essential component of your balance sheet.

⛔ Operational Disruptions

A shutdown—whether for days, weeks, or months—leads to lost revenue, stalled productivity, and broken supply chains. This sudden change in performance will show up in trailing financials and lower your company’s value to potential buyers or lenders.

💡 Buyer and Lender Confidence

A history of disasters (especially if you're uninsured or underprepared) may raise red flags for investors or banks. They may factor in higher perceived risk, increasing your cost of capital or decreasing your business’s marketability.

2. Long-Term Value Erosion

📉 Lower Earnings Multiples

Valuations often rely on multiples of earnings (EBITDA or revenue). If a disaster drags down earnings—even temporarily—it can lower your valuation for years.

Example:

A business typically valued at 5× EBITDA might only get 3× if recent performance reflects instability or prolonged recovery.

🚫 Reputational Damage

If customers perceive a decline in service or safety, long-term revenue projections could drop, reducing forecasted cash flows used in valuation models.

🔍 Reduced Buyer Interest

Many buyers shy away from businesses that appear high-risk or require major capital investments to restore. This limits your pool of acquirers, which can drive down offers.

3. Insurance Gaps and Their Consequences

🧾 Uninsured or Underinsured Losses

If your business doesn't carry adequate insurance—or fails to claim in time—you may be responsible for recovery costs. This financial strain can result in higher liabilities and lower working capital, both of which impact valuation metrics.

⚠️ Pending Claims or Litigation

Ongoing insurance disputes or lawsuits stemming from the disaster can appear on your books as contingent liabilities. Investors and buyers often subtract these risks from the total business value.

4. How to Preserve or Regain Business Value

✅ Document Everything

After a disaster, meticulous records of damage, downtime, and recovery costs can help:

Justify losses to insurers

Inform updated financial models

Reassure stakeholders and appraisers

✅ Rebuild with Resilience in Mind

Buyers favor businesses that show disaster-readiness. Investing in prevention, continuity planning, and strong leadership during recovery can demonstrate operational strength and add to long-term value.

✅ Seek Professional Valuations

Have your business reassessed after the dust settles. A valuation expert can adjust for one-time events and explain to buyers or funders why your business remains strong.

5. How Business Networks Can Help You Rebound

Engaging with a strong network of recovery professionals—public adjusters, consultants, financial advisors, legal experts—can speed up your recovery and strengthen your positioning. These networks also connect you with:

Grant and loan programs

Business continuity services

Buyers, funders, or partners interested in rebuilding efforts

A robust support system helps reduce downtime and restore stakeholder confidence, which can go a long way in protecting your business valuation.

Natural disasters don’t just destroy physical assets—they threaten the financial core of your business. But with smart strategies and support, your business can recover and retain much of its value.

Key Takeaways:

Disasters can lower business valuations due to asset loss, reduced revenue, and investor uncertainty.

Uninsured losses and reputational damage can have long-lasting effects.

Proactive recovery, strong documentation, and expert support are key to preserving value.

How Business Networks Can Aid in Recovery

Click the "Get Assistance" button to begin the process — we are here to help!

Hear What Our Clients Say

Job Search Agency - FL

"The Economic Recovery team was outstanding with our ERC tax credit. They were highly communicative, very thorough, and their attention to details provided us comfort should anything need to be reviewed. We are recommending them to other companies we do business with as well."

Veteran Non-Profit - IN

"Thank you so much for providing your service. As a non-profit the majority of our help is volunteer. We didn't think we would qualify for this program. Thanks to your team we not only qualified, we will also make up for our shortfall from our last 2 years of little activity in our Donor Campaigns."

Medical Facility - FL

"As an essential business there was no thought to applying for the Employee Retention Credit program. Once we explored all of the various companies providing the same service, we knew we made the right decision when they asked to speak with our in-house legal department first, not just pushing a contract."

Tech Firm - NY

"Our CPA said we did not qualify because we broke even in 2020 and made money in 2021 even though we had to change our entire business. When we spoke with Economic Recovery we found out that we qualified and had ERC available above our 2 PPP grants, we were amazed. They understand this program inside and out."

Privacy Policy------------------Terms of Use

© 2025 Economic Recovery Center - All Rights Reserved - DISCLAIMER - ERC serves as a referral service for the disaster recovery, public adjusting, and legal industries. We collaborate with reputable firms across the U.S., acting as their trusted referral agent.

Powered by NURO.is, Inc.